Social Security Taxable Wage Base 2025. According to the intermediate projection issued in a may 2025 report, the social security taxable wage next year will be $174,900. Only withhold and contribute social security taxes until an employee earns above the wage base.

The social security administration (ssa) recently announced that, for 2025, the maximum amount of earnings subject to the social security tax — also known as the social security taxable wage base — will increase to $168,600 from $160,200 (a 5.2 percent increase). Taxable wage base when you can stop.

Limit For Maximum Social Security Tax 2025 Financial Samurai, You could do similar things today. A new tax season has arrived.

2025 Tax Brackets And How They Work Ericka Stephi, Only withhold and contribute social security taxes until an employee earns above the wage base. The 2025 social security wage base is $168,600, up from the 2025 limit of $160,200.

Social Security Maximum Taxable Earnings 2025 2025 DRT, The wage base limit is the maximum wage that's subject to the tax for that year. Raise taxes or cut benefits.

Social Security Tax Wage Base is Going Up 5.2 for 2025 CPA Practice, Are social security benefits taxable? Most americans have to pay social security tax for their entire working lives, but there are a few exceptions to that rule.

Social Security Taxable Amount 2025 Jacky Liliane, So, those are the two basic options: Additionally, social security benefits will increase.

What You Need to Know About Taxable Wages 3 Things, Taxable wage base when you can stop. There is no wage base limit for.

How To Calculate Taxable Social Security 2025, Irs reminds taxpayers their social security benefits may be taxable | internal revenue service. Only withhold and contribute social security taxes until an employee earns above the wage base.

How To Calculate, Find Social Security Tax Withholding Social, So, for 2025 employers must withhold the following amounts: The maximum 2025 social security component of the federal insurance contributions act tax payable by each employee will be $10,453.20, or 6.2% of the.

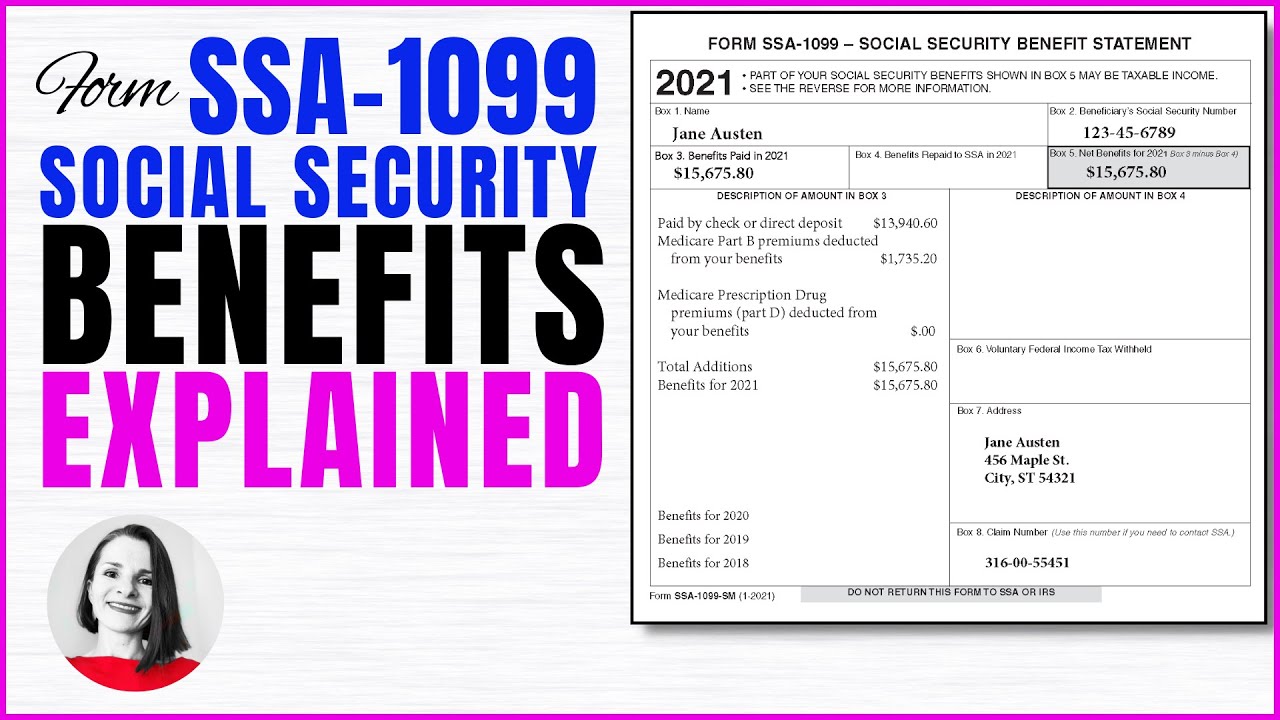

Tax Form SSA1099 Social Security Benefit Explained Is My Social, Wealthier taxpayers will have more social security tax taken from their paychecks this year due to a wage. The social security wage base limit is $160,200.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2025.

Employers In 2025, the Social Security Wage Base is Going Up News, Ssa estimates wage base of. The social security administration (ssa) recently announced that, for 2025, the maximum amount of earnings subject to the social security tax — also known as the social security taxable wage base — will increase to $168,600 from $160,200 (a 5.2 percent increase).